How To Calculate How Much Money Needs To Raise By Startups

Many startups make fatal mistakes when calculating their financing needs. After running successful ventures, serving on boards of prominent startups, and advising hundreds of emerging entrepreneurs, HBS professors Shikhar Ghosh, Ramana Nanda, and William Sahlman observed common mistakes startups make when determining maximum financing needs. Hither's an overview of iii essential things to help you effigy out how much capital you lot need to raise to scale effectively, without getting overwhelmed past options and opinions, or swayed by offers.

three Hacks for Computing How Much You Need to Raise

- Map out your cumulative cash period needs.

- Don't let your desired valuation drive your approach. Think strategically.

- Don't rely on "best" fiscal practices as you grow.

Understanding and applying each do will help y'all proceeds a realistic idea of the amount of funding you need to scale.

Map Your Cumulative Cash Flow Needs

Map Your Cumulative Cash Flow Needs

Acquirement growth and profitability are of import, but without positive cash period, a company cannot remain in control of its destiny. To determine how much you need to scale, you need to understand the importance of cash flow.

Free cash flow (FCF) is the amount of cash your company generates after paying all operating and capital expenses.

Your greenbacks flow influences a range of issues, including your level of buying and control over your company and it defines the risk VCs acquaintance with your company. It's common for founders to create a growth plan without considering the dynamics of cash flow and to underestimate the fluid relationship between cash flow and growth. Shikhar Ghosh, Professor of Business organisation Administration at HBS, entrepreneur, and investor dubbed a "Principal of the Internet Universe" byForbes, observes,

"Then many founders focus on the cease goal—they want to grow their business. They don't realize that growth tin actually kill their company because without positive cash flow a company cannot remain in control of its destiny."

Statistics support this statement. In 2017, over 70% of tech startups failed to exit or raise follow-on fundingdespite their growth. About everyone has heard that "cash is rex"; what makes cash flow and then widely misunderstood and easy to miscalculate?

The short answer: growth—particularly rapid growth—diminishes greenbacks menstruation and that shortage tin create myriad unanticipated problems. What can you do to avoid this? Get familiar with your cumulative cash catamenia bendbefore seeking investment, empathise the factors that drive cash flow, and develop a strong greenbacks management plan that accounts for the growth'southward affect on greenbacks flow.

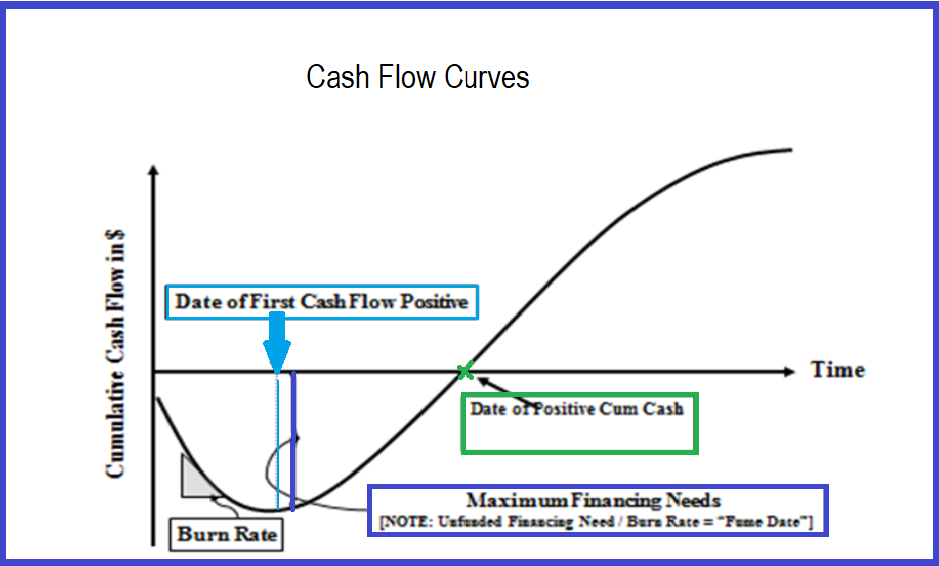

Cash Catamenia Curve

Cash menstruation incorporates items that go into the income statement, such as profit margin, and items that go into the residual sheet, such as changes in working capital required.

We tin define gratis cash catamenia (FCF) as:

FCF = EBIAT – (CAPEX – DEPRECIATION) – Δ NET WORKING CAPITAL

In most early stage companies, the greenbacks menstruum curve starts at cypher. The charge per unit at which greenbacks declines every bit you use it is known as the fire rate. As your expenses go along to accumulate, you burn through greenbacks and hit the bottom of the bend. When the curve begins turns upwards, you lot commencement making a turn a profit.

Don't Count Projected Acquirement as Bachelor Cash

From a quantitative perspective, determining cash flow at a given point seems straightforward. Only information technology'due south surprisingly like shooting fish in a barrel to overestimate your cash catamenia when determining maximum financing needs. Ghosh observes that "Many startups make up one's mind their funding needs past estimating the point at which revenue will arrive, then making plans based on that predicted revenue. But revenue often takes longer to go far." This invariably leads to greenbacks flow shortages.

The unfunded time between your date of first cash flow positive and maximum financing needs is known as thesmoke engagement—an estimated point for when a business organisation will deplete its cash and run on fumes until it collapses.

Factors to Consider When Calculating Finance Needs

- What is your overall internet present value?

- What is the shape of your cash flow bend?

- How long it will take to reach positive cash flow? How deep volition the trough plunge?

Don't Let a Desired Valuation Bulldoze Your Determination

Don't Let a Desired Valuation Bulldoze Your Determination

Often, the respond to "how much money should I raise?" becomes influenced by emotion, instead of strategic thinking. Some founders determine an amount and consider how investment affects their dilution, without mapping out cash flow. Ghosh notes this as a common but potentially fatal mistake.

"Many founders say, 'I want to get 2 million dollars and I want to give up 40%.' They assume they tin become to the next round, merely they haven't done the calculations or seen the implications. Working in this way, most don't make information technology."

Shikhar Ghosh

If you seek a high valuation at the offset, understand the consequences: receiving a big sum upfront volition typically be deemed a higher gamble, diluting your disinterestedness. Many founders opt to have the trade-off because they've become attached to the idea of raising a certain corporeality.

Reduce Uncertainty and Risk in Stages

The problem is, it's rare that one round of financing will meet well-nigh startup's needs. A growing business concern encounters many variables—market changes, emerging competitors, and changes in customers' tastes. Plus, unforeseen opportunities ofttimes arise so information technology'due south nearly impossible to predict your needs with precision.Ramana Nanda, professor of business administration at HBS, summarizes, "Money is time. You must consider time and money simultaneously."

Ask yourself, "how much time do I need to effigy out my uncertainties? How much time do I need to evidence my hypothesis?" And then, when yous have that number, add a substantial buffer to buy yourself the time you need.

Calculating how much to raise in this manner, instead of striving to hit a detail number or valuation, increases your chances of succeeding as it forces you to call back strategically and incorporate your business model into your fundraising plan. As William A. Sahlman, Professor of Business Assistants at HBS summarizes,

"You enhance coin to buy fourth dimension. You buy time to run experiments. You run experiments to reduce uncertainty. You reduce uncertainty to get more than coin."

William A. Sahlman

Most founders receive funds in installments–after you lot accomplish agreed-upon milestones or inflection points. When you lot achieve an inflection point without running out of cash, you evidence your value and unlock another circular of funding. Each time you come across an inflection bespeak you minimize your dilution, decrease your take chances to investors and the valuation of your visitor rises. That cycle repeats through subsequent funding rounds.

When y'all don't have enough cash menses circulating and can't reach an inflection betoken, you enter dangerous territory. You lot need to enhance more funding just to stay alive. And raising a new round when y'all're short on cash puts you in the precarious position of a down round.

Don't rely on past behaviors or best financial practices every bit you scale

Don't rely on past behaviors or best financial practices every bit you scale

As you scale, you may demand to temporarily suspend some financial best practices. For instance, focusing on revenue growth, establishing assets, and long-term savings seems smart. Many people reasons that buying part space instead of renting may save money in the long run, considering you're investing in an asset. Many startups believe that, while acquiring a customer is expensive, over time, the customer will more than pay back the costs. But both rationales can exist harmful from a cash flow perspective.

Assets Drain Cash Menses

Acquiring assets may be beneficial in the hereafter, but assets compound cash flow. Similarly, high customer conquering costs create low profitability in the short term, with the additional risk that your customer lifetime value may modify or become lower than you estimated.

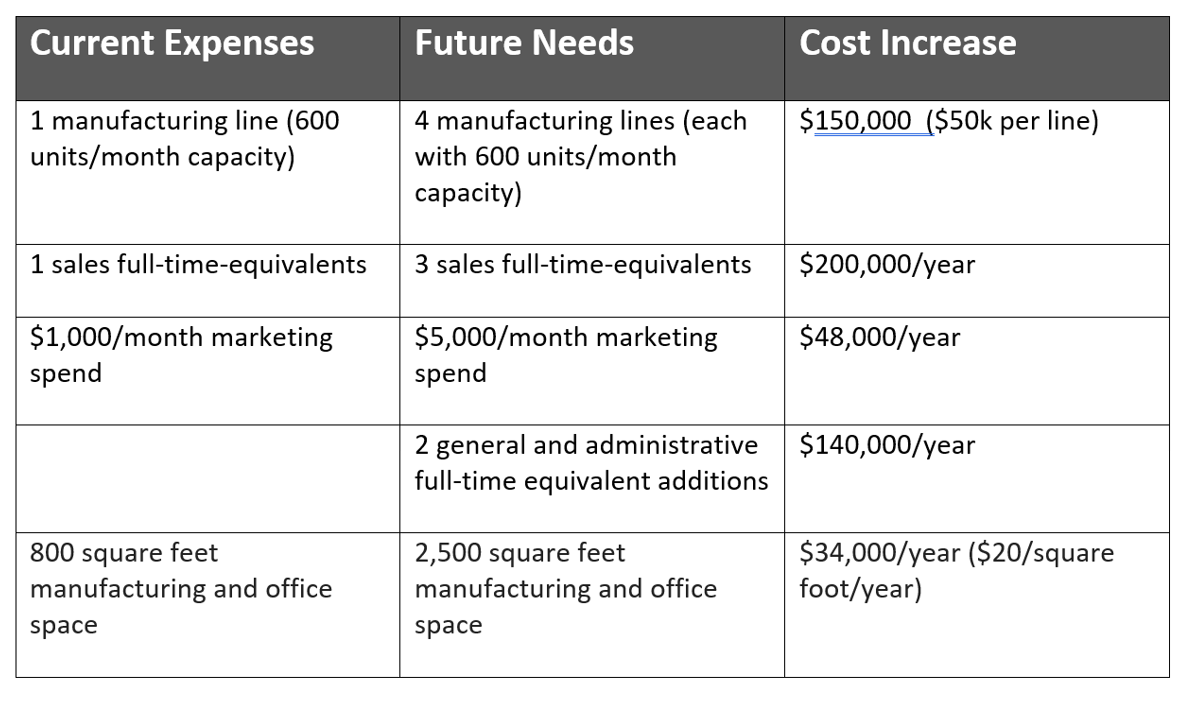

Imagine you own a company that makes cell phone covers with a built-in bombardment pack. Customers honey the product design and sales have skyrocketed. You lot sell each cell phone case for $99 and generate $15 of profit per sale. You've reached manufacturing and sales capacity and the potential market size has expanded exponentially. You're prepare to scale. Your current turn a profit won't cover the ascent expenses for manufacturing, sales, and overhead needed to grow, so you're seeking funding, trying to make up one's mind how much to raise.

Using Your Current Model to Predict Growth Needs Will Backfire

At this stage, well-nigh founders utilize their current business and financial models to predict total funding needs, similar this:

In this case, based on in-house manufacturing and sales capabilities, you predict cost increases to aggrandize. This approach is mutual but curt-sighted.

Key Mistakes

- Neglecting to build in room for unexpected expenses or spiraling costs.

- Not accounting for the likelihood of time overruns.

- Bold that efficiency will increase in a keen linear style, in tandem with growth.

- Failing to consider cash flow in relation to other business decisions.

The strategies that worked to become the company to its current betoken might hinder it every bit it scales. For instance, outsourcing production at this bespeak might pb to lower profitability;butit could also reduce cash menstruation deficit. Having more cash available could reduce total funding needs, enabling the founders to retain more ownership. Cash allows you to answer to unexpected obstacles or opportunities that arise.

Startups are affected past both external and internal forces. Choices that worked for a competitor may not work for your company because of your cash flow state of affairs. Decisions that worked for you in the by may not piece of work as y'all scale.

Your Questions & Answers

Source: https://startupguide.hbs.edu/fundraising/fundraising-pitching/3-hacks-for-calculating-how-much-your-startup-needs-to-raise/

Posted by: messerhusad1974.blogspot.com

0 Response to "How To Calculate How Much Money Needs To Raise By Startups"

Post a Comment