How To Get The Ppp Loan

Update March 30, 2021: The President has signed the PPP Extension Act. It gives business owners until May 31, 2021 to apply for PPP loans.

Need More Funding?

Nav serves nearly every kind of business, and our experts will match you to the right fit for your business needs.

Get Matched

One of the more confusing aspects of the Paycheck Protection Program (PPP) is how to apply for a PPP loan if you are self-employed, including if you are a 1099 contractor or gig worker.

Here we will answer common questions we've received including:

- How do I calculate my payroll or salary if I am self-employed?

- What if I have not filed my 2020 tax return?

- If I had a loss in my business do I qualify?

- What expenses may be included in the forgiven amount?

By way of background, the Economic Aid Act (stimulus bill) passed December 27, 2020 includes funding for three types of PPP loans:

- First time PPP loans for businesses that qualified under the CARES Act but did not get a loan ("first draw" PPP loans);

- Second draw PPP loans for businesses that obtained a PPP loan but need additional funding; and

- Additional funding for businesses that returned their first PPP loan or for certain businesses that did not get the full amount for which they qualified.

Read more about new PPP loans included in the Economic Aid Act (the "stimulus bill") here.

We encourage you to review the SBA guidance carefully and discuss it with your tax professional, attorney, or financial advisor to clarify how it applies to your business.

See How Much SBA Loan Money You Qualify For

Use our CARES Act SBA loan calculator to see how much money your business may qualify to get.

Use the Calculator

How To Calculate PPP Loan Amount If You Are Self Employed

Here we are focusing on those who are self-employed and who file a Form 1040, Schedule C. As a reminder, the SBA states you may be eligible for a PPP loan if:

- You were in operation on February 15, 2020;

- You are an individual with self-employment income (such as an independent contractor or a sole proprietor);

- Your principal place of residence is in the United States; and

- You filed or will file a Form 1040 Schedule C for 2019 or 2020.

For those who are self-employed and file a Form 1040, Schedule C, the SBA provides separate calculations based on whether or not you have employees. You will find those below.

Update: On March 3, 2021 the SBA released a new Interim Final Rule that applies to PPP applicants who are self-employed. Prior to this change, self-employed borrowers who file Schedule C used line 31 of their Schedule C (net profit) to calculate the owner's compensation portion of their loan amount. The new calculation provides more flexibility, allowing borrowers to use net profit or gross income. (If you have already applied for PPP using net profit, see the FAQ below: Can I Request More Money If I Used Net Profit?)

Note: Do not include payments you make to 1099 contractors in your payroll. They can apply for PPP themselves.

First Draw PPP Loan If You Have No Employees

If you are self-employed and have no employees, the SBA provides the following instructions in the March 3, 2021 for new PPP loan borrowers:

If you have no employees, use the following methodology to calculate your maximum loan amount:

Step 1: From your 2019 or 2020 IRS Form 1040, Schedule C, you may elect to use either your line 31 net profit amount or your line 7 gross income amount. (If you are using 2020 to calculate payroll costs and have not yet filed a 2020 return, fill it out and compute the value.) If this amount is over $100,000, reduce it to $100,000. If both your net profit and gross income are zero or less, you are not eligible for a PPP loan.

Step 2: Calculate the average monthly net profit or gross income amount (divide the amount from Step 1 by 12).

Step 3: Multiply the average monthly net profit or gross income amount from Step 2 by 2.5. This amount cannot exceed $20,833.

This is the amount most self employed borrowers with no employees will use to qualify for a first-time PPP loan.

How to Substantiate Your Income (Self-Employed No Employees)

You must provide the 2019 or 2020 (whichever you used to calculate loan amount) Form 1040 Schedule C with your PPP loan application to substantiate the amount for which you applied. You must also include a 2019 or 2020 (whichever you used to calculate loan amount) IRS Form 1099-MISC detailing non-employee compensation received (box 7), invoice, bank statement, or book of record that establishes you are self-employed. If using 2020 to calculate loan amount, this is required regardless of whether you have filed a 2020 tax return with the IRS. You must provide a 2020 invoice, bank statement, or book of record to establish you were in operation on or around February 15, 2020.

First Draw Loan If You Have Employees

If you are self-employed with employees, the SBA provides the following instructions.

Step 1: Compute 2019 or 2020 payroll (using the same year for all items) by adding the following:

a. At your election, either (1) the net profit amount from line 31 of your 2019 or 2020 IRS Form 1040, Schedule C, or (2) your 2019 or 2020 gross income minus employee payroll costs, calculated as your gross income reported on IRS Form 1040, Schedule C, line 7, minus your employee payroll costs reported on lines 14, 19, and 26 of IRS Form 1040, Schedule C (for either option, if you are using 2020 amounts and have not yet filed a 2020 return, fill it out and compute the value), up to $100,000 on an annualized basis, as prorated for the period during which the payments are made or the obligation to make the payments is incurred (if this amount is over $100,000, reduce it to $100,000, or if this amount is less than zero, set this amount at zero);

b. 2019 or 2020 gross wages and tips paid to your employees whose principal place of residence is in the United States, computed using 2019 or 2020 IRS Form 941 Taxable Medicare wages & tips (line 5c, Column 1) from each quarter plus any pre-tax employee contributions for health insurance or other fringe benefits excluded from Taxable Medicare wages & tips; subtract any amounts paid to any individual employee in excess of $100,000 on an annualized basis, as prorated for the period during which the payments are made or the obligation to make the payments is incurred, and any amounts paid to any employee whose principal place of residence is outside the United States; and

c. 2019 or 2020 employer contributions to employee group health, life, disability, vision and dental insurance (portion of IRS Form 1040, Schedule C line 14 attributable to those contributions); retirement contributions (IRS Form 1040, Schedule C, line 19); and state and local taxes assessed on employee compensation (primarily under state laws commonly referred to as the State Unemployment Tax Act or SUTA from state quarterly wage reporting forms).

Step 2: Calculate the average monthly amount (divide the amount from Step 1 by 12).

Step 3: Multiply the average monthly amount from Step 2 by 2.5.

How to Substantiate Your Income (Self-Employed With Employees)

You must supply your 2019 or 2020 (whichever you used to calculate loan amount) Form 1040 Schedule C, Form 941 (or other tax forms or equivalent payroll processor records containing similar information) and state quarterly wage unemployment insurance tax reporting forms from each quarter in 2019 or 2020 (whichever you used to calculate loan amount) or equivalent payroll processor records, along with evidence of any retirement and health insurance contributions, if applicable. A payroll statement or similar documentation from the pay period that covered February 15, 2020 must be provided to establish you were in operation on February 15, 2020.

If you use a payroll processing service ask them for a CARES Act report. It should include that information.

Do you need more financing?

Sign up for Nav to see what financing options are available for your business.

Get matched

If You are a Partner In a Partnership

The SBA has previously clarified that while partnerships are eligible for PPP loans, a partner in a partnership may not submit a separate PPP loan application for themselves as a self employed individual. (The IFR released March 3, 2021 did not change the calculation for partnerships.) The following methodology should be used to calculate the maximum amount that partnerships can borrow:

Step 1: Compute 2019 payroll costs by adding the following:

2019 Schedule K-1 (IRS Form 1065) Net earnings from self-employment of individual U.S.-based general partners that are subject to self-employment tax, multiplied by 0.9235,5 up to $100,000 per partner:

- Compute the net earnings from self-employment of individual U.S.-based general partner that are subject to self-employment tax from box 14a of IRS Form 1065 Schedule K-1 and subtract (i) any section 179 expense deduction claimed in box 12; (ii) any unreimbursed partnership expenses claimed; and (iii) any depletion claimed on oil and gas properties;

- if this amount is over $100,000, reduce it to $100,000;

- if this amount is less than zero, set this amount at zero;

2019 gross wages and tips paid to employees whose principal place of residence is in the United States (if any), up to $100,000 per employee, which can be computed using:

- 2019 IRS Form 941 Taxable Medicare wages & tips (line 5c-column 1) from each quarter,

- Plus any pre-tax employee contributions for health insurance or other fringe benefits excluded from Taxable Medicare wages & tips, and

- Minus any amounts paid to any individual employee in excess of $100,000 and any amounts paid to any employee whose principal place of residence is outside the United States;

- 2019 or 2020 employer contributions for employee group health, life, disability, vision and dental insurance, if any (portion of IRS Form 1065 line 19 attributable to those contributions);

- 2019 or 2020 employer contributions to employee retirement plans, if any (IRS Form 1065 line 18); and

- 2019 or 2020 employer state and local taxes assessed on employee compensation, primarily state unemployment insurance tax (from state quarterly wage reporting forms), if any.

Step 2: Calculate the average monthly payroll costs (divide the amount from Step1 by 12).

Step 3: Multiply the average monthly payroll costs from Step 2 by 2.5.

How to Substantiate Your Income (Partnership)

The partnership's 2019 IRS Form 1065 (including K-1s) must be provided to substantiate the applied-for First Draw PPP Loan amount. If the partnership has employees, other relevant supporting documentation, including the 2019 IRS Form 941 and state quarterly wage unemployment insurance tax reporting form from each quarter (or equivalent payroll processor records or IRS Wage and Tax Statements) along with records of any retirement or group health, life, disability, vision, and dental insurance contributions must also be provided to substantiate the First Draw PPP Loan amount.

If the partnership has employees, a payroll statement or similar documentation from the pay period that covered February 15, 2020 must be provided to establish the partnership was in operation and had employees on that date. If the partnership has no employees, an invoice, bank statement, or book of record establishing the partnership was in operation on February 15, 2020 must instead be provided.

If Your Business is an LLC

How to calculate your loan amount will depend on how your LLC files its taxes. The SBA states that "LLCs should follow the instructions that apply to their tax filing status in the reference period used to calculate payroll costs (2019 or 2020)—i.e., whether the LLC filed (or will file) as a sole proprietor, a partnership, or a corporation in the reference period."

If Your Business is an S Corp

If you are self-employed and your business operates as an S Corporation, you may qualify based on payroll (including payroll you pay yourself). However, if you only pay yourself compensation through owner's draw or distributions, you may not qualify. We recommend you read: Does Owner's Draw Qualify as Payroll for the PPP Program ?

Second Draw PPP Loans

The stimulus legislation created second draw PPP loans for those who:

- Previously received a first draw PPP Loan and has or will use the full amount only for authorized uses by the date the second loan is disbursed;

- Have no more than 300 employees; and

- Can demonstrate at least a 25% reduction in gross receipts between comparable quarters in 2019 and 2020.

More information about qualifying for a second draw PPP loan can be found here.

The calculation for second draw loans is similar to first draw loans with one exception: if your business has a NAICS code beginning in 72 (which is generally food service and accommodations businesses) you may qualify for a loan of 3.5 times average monthly payroll. Other businesses will qualify based on 2.5 times average monthly payroll as before.

The March 3, 2021 Interim Final Rule describes the following method for calculating the loan amount:

"The maximum amount of a Second Draw PPP Loan to a borrower that has income from self-employment and files an IRS Form 1040, Schedule C, is calculated as follows, depending on whether the borrower has employees:

(i) For a borrower that has income from self-employment and does not have any employees, the maximum loan amount is the lesser of:

(A) the product obtained by multiplying: (1) the net profit or gross income of the borrower in 2019 or 2020, as reported on IRS Form 1040, Schedule C, that is not more than $100,000, divided by 12; and (2) 2.5 (or, only for a borrower assigned a NAICS code beginning with 72…at the time of disbursement, 3.5).

This amount cannot exceed $29,167 for NAICS code 72 borrowers and $20,833 for all other borrowers.

(ii) For a borrower that has income from self-employment and has employees, the maximum loan amount is the lesser of: (A) the product obtained by multiplying:

(1) the sum of (i) one of the two following options, up to $100,000; if this amount is less than zero, set this amount at zero (if you are using 2020 and have not yet filed a 2020 return, fill it out and compute the value):

- the borrower's net profit reported on IRS Form 1040, Schedule C for 2019 or 2020, divided by 12;

- or line 7 from the borrower's 2019 or 2020 IRS Form 1040, Schedule C, minus lines 14, 19, and 26, divided by 12; and

(ii) the average total monthly payment for employee payroll costs incurred or paid by the borrower during the same year elected by the borrower; by (2) 2.5 (or, only for a borrower assigned a NAICS code beginning with 72 at the time of disbursement; or (B) $2,000,000.

What If I Have Not Filed my 2020 Tax Return for My Business?

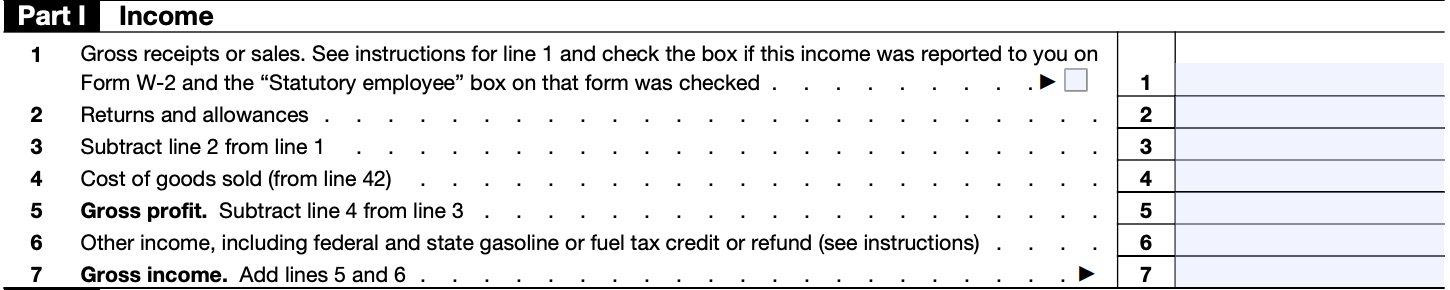

The SBA does not state that you must file your 2020 tax return before you apply. The good news is that if you want to qualify based on your gross income (line 7), you'll only need to complete lines 1-7 of your Schedule C to get that number used to calculate your loan amount. For many independent contractors, self-employed individuals and gig workers, that should be pretty simple. You'll find Schedule C instructions here. (Be sure to check with your tax professional if you have questions.)

Here's what that first section of Schedule C looks like:

Alternatively you may use information from your 2019 Schedule C to qualify instead.

What If My Business Showed a Loss?

Prior to the March 3, 2021 change, if you were self-employed and did not have employees, your business must have showed a net profit on either your 2019 or 2020 Schedule C to qualify for PPP. Now your business must show gross income or a net profit to qualify. Self-employed individuals with employees may also qualify based on payroll plus owner's compensation using the methods described above. More businesses are likely to qualify for PPP using the new calculation.

Can I Request More Money If I Used Net Profit?

If you applied for PPP as a self-employed individual using net profit, you may discover you could get a larger loan by using gross income. The change in calculation methods is not retroactive. The IFR states that it applies to "loans approved after the effective date.

However, it appears that whether you can get a larger loan amount depends on the status of your loan. Information provided by SBA to lenders states that a lender may cancel a PPP loan application and submit a new application on behalf of the borrower all the way up to the point where the loan funds have been disbursed to the borrower but a Form 1502 (reporting the loan) has not been submitted by the lender to the SBA. (The borrower would have to repay the loan first.)

Once the loan has been disbursed and the lender has filed Form 1502 with the SBA, there is no option to reapply for a larger amount.

Contact your lender if you have already submitted a loan application based on Schedule C net profits and have questions about the new calculations.

Keep in mind that if you already qualified based on the maximum owner's compensation of $20,833 based on net profit on your Schedule C there is no need to do anything. (For second draw loans to businesses with a NAICS code starting in 72, the maximum amount based solely on owner's compensation is $29,167).

Is There a Downside to Using Gross Income Instead of Net Profit?

Possibly. PPP borrowers must certify that "current economic uncertainty makes this loan request necessary to support the ongoing operations of the Applicant." However, there has been a "safe harbor" for loans below $2 million.

The SBA appears to be concerned that the gross income calculation may be more subject to fraud or abuse. So it has warned that "if a Schedule C filer elects to use gross income to calculate its loan amount on a First Draw PPP Loan and the borrower reported more than $150,000 in gross income on the Schedule C that was used to calculate the borrower's loan amount, the borrower will not (emphasis added) automatically be deemed to have made the statutorily required certification concerning the necessity of the loan request in good faith, and the borrower may be subject to a review by SBA of its certification."

It goes on to say that "SBA will review a sample of the population of First Draw PPP Loans made to Schedule C filers using the gross income calculation if the gross income on the Schedule C used to calculated the borrower's loan amount exceeds the threshold of $150,000. If the borrower exceeds this threshold, then SBA will, for the sample drawn, assess whether these borrowers complied with the PPP eligibility criteria, including the good faith loan necessity certification."

Although second draw PPP loan borrowers must still make the economic necessity certification, the SBA does not appear to be as concerned about these applicants, since they must demonstrate a 25% reduction in receipts. It says: "all Second Draw PPP Loan Borrowers will be deemed to have made the required certification concerning the necessity of the loan in good faith."

What Is the January/February Period I've Heard Referenced?

The CARES Act became law March 27, 2020 and in the first round of PPP, self employed business owners did not get instructions on how to calculate payroll right away. When the guidance did come out, it did not include instructions for businesses that weren't in business in 2019 but were in business by the deadline of February 15, 2020 required to qualify.

Later the SBA provided instructions for businesses that were not in business in 2019 but were in business in January and February 2020. Those instructions generally allowed those businesses to calculate their loan amount using their average monthly payroll costs incurred in January and February 2020. This calculation is still an option, or the business may use all of 2019 or all of 2020 to qualify. For details on how to calculate the January/February option, see the SBA guidance dated January 17, 2021: Questions 10 & 11.

Can I Use PPP to Refinance My EIDL Loan?

Some borrowers have received both a PPP loan and an Economic Injury Disaster Loan (EIDL). There are some very specific but limited circumstances where you can refinance an EIDL loan with PPP. (Note we are talking about an EIDL loan here, not the EIDL grant or advance.) Pay careful attention to the dates here!

- You must use PPP to refinance your EIDL if you received EIDL loan funds from January 31, 2020 through April 3, 2020; and used the EIDL loan funds to pay payroll costs.

- You may (optionally) use PPP to refinance EIDL loan funds received from January 31, 2020 through April 3, 2020; and you used the EIDL loan for purposes other than payroll costs.

- You cannot use PPP to refinance an EIDL loan if you received EIDL loan funds before January 31, 2020 or after April 3, 2020. This is the majority of borrowers.

What Else Do I Need to Apply?

In addition to the tax documents you used to calculate your loan amount, you will need the following documentation:

- A copy of your driver's license or passport.

- A voided check for the deposit of your PPP loan. Some lenders require you have a business bank account. If you don't have one, we recommend opening one so your PPP funds can be deposited into that account. This will make it easy to track how you spend PPP funds.

- For second draw PPP loans you must have the number from your first PPP loan. SBA loan numbers (PLP) have eight numbers followed by a dash then two more numbers (i.e., XXXXXXXX-XX).

What Expenses Can I Use My PPP Loan For?

It's important to spend your loan proceeds correctly if you want to qualify for full forgiveness. The SBA has established some very specific guidance regarding the use of PPP loan proceeds for those with income from self-employment who file a Form 1040, Schedule C.

With the new rule the SBA introduced a new term called "proprietor expenses" and describes it like this: "In the context of determining a borrower's eligible expenses and forgiveness amount, this interim final rule refers to the owner compensation share of a Schedule C filer's loan amount as 'proprietor expenses'."

PPP is intended to keep workers on payroll, and that may include compensation for self-employed individuals. In fact, full forgiveness generally requires the business to use at least 60% of PPP funds for payroll related expenses during specific time periods. The March 3, 2021 guidance from the SBA describes it this way:

- For borrowers that use net profit to calculate loan amount, owner compensation replacement, calculated based on 2019 or 2020 (using the same year that was used to calculate the loan amount) net profit.

- For borrowers that use gross income to calculate loan amount, proprietor expenses (business expenses plus owner compensation), calculated based on 2019 or 2020 (using the same year that was used to calculate the loan amount) gross income (this amount cannot exceed $20,833).

- For borrowers who used gross income to calculate the loan amount and have no employees, proprietor expenses equal gross income.

- For borrowers who used gross income to calculate the loan amount and have employees, proprietor expenses equal the difference between gross income and employee payroll costs.

For businesses with employees, payroll may also include employee payroll costs for employees whose principal place of residence is in the United States.

In addition, borrowers may qualify for full forgiveness if they use up to 40% of PPP funds for other eligible expenses during the covered period. These include:

- Mortgage interest payments* (but not mortgage prepayments or principal payments) on any business mortgage obligation on real or personal property (e.g., the interest on your mortgage for the warehouse you purchased to store business equipment or the interest on an auto loan for a vehicle you use to perform your business),

- Business rent payments (e.g., the warehouse where you store business equipment or the vehicle you use to perform your business), and

- Business utility payments (e.g., the cost of electricity in the warehouse you rent or gas you use driving your business vehicle).

- Interest payments on any other debt obligations that were incurred before February 15, 2020 (such amounts are not eligible for PPP loan forgiveness).

- The stimulus legislation created a new category of covered expenses that may be included in non-payroll costs. We detailed those in this article about the new PPP loans. These expanded expense categories apply to anyone with a PPP loan that has not yet been forgiven, even if you received it in 2020.

*Note that you must have claimed these expenses on your Form 1040 Schedule C to include those costs for forgiveness purposes.

For many self-employed individuals, PPP loan forgiveness will be based largely or entirely on owner's compensation replacement. We discuss this in detail in our article: Self-employed: How to Fill Out the PPP Forgiveness Application .

The Bottom Line on Applying for PPP When Self-Employed

If you qualify for PPP, by all means be sure to apply. This loan may be fully forgiven and may provide essential funding to your business.

That said, it will be a lot easier to apply for PPP if your bookkeeping is up to date and you have kept good records of the income and expenses of your business. If you have operated your business with cash payments that you did not report to the IRS, co-mingled personal and business funds, or if you have maximized expenses to the point where your business only shows a loss, you are likely not going to be able to qualify for the PPP loan your business may have been entitled to otherwise. Your accounting professional can prove invaluable in this process so make sure you enlist their help in determining which COVID relief programs are best for your business.

This article was originally written on April 14, 2020 and updated on March 30, 2021.

Rate This Article

This article currently has 292 ratings with an average of 4.5 stars.

How To Get The Ppp Loan

Source: https://www.nav.com/blog/self-employed-how-to-apply-for-a-payroll-protection-program-ppp-loan-600275/

Posted by: messerhusad1974.blogspot.com

0 Response to "How To Get The Ppp Loan"

Post a Comment